Looking after your eyesight is crucial, and health funds in Australia can significantly reduce the cost of prescription eyewear. Salisbury Optometrist brings you this compelling guide so you can delve into how Health Fund Glasses work and how you can leverage them for optimal vision care.

Understanding Health Insurance for Optical Care

Australian health insurance offers two main coverage types: extras and hospital. Extras cover helps manage out-of-hospital expenses like prescription glasses and contact lenses, while hospital cover assists with inpatient treatment within private hospitals. The specific services covered depend on your chosen level of coverage, with higher tiers typically offering more comprehensive benefits but at a higher cost.

For instance, while Medicare provides one free eye test every three years for individuals under 65, it doesn’t cover glasses or contact lenses. This is where Health Fund Glasses come in – extras covered by your health fund can significantly reduce the financial burden of these essential vision aids.

Why Choose Health Fund Glasses?

The cost of prescription glasses, contact lenses, and eye therapy can quickly add up. Health Fund Glasses can significantly reduce these expenses, making vision care more accessible. Here’s a closer look at the advantages:

- Reduced Out-of-Pocket Costs: Health funds typically offer rebates for optical services, often paying more for them than for any other extra service besides dental. This means significant savings on your prescription eyewear needs.

- Faster Access to Treatment: With private hospital cover, you can avoid lengthy public waiting lists for elective eye procedures like cataract surgery. This allows you to receive treatment sooner and get back to your daily life without delay.

- More Choices: Health Fund Glasses can open doors to a broader range of vision solutions. You can explore options like prescription sunglasses and contact lenses, which can enhance your vision and style.

Selecting the Right Optical Cover

Once you’ve decided to use Health Fund Glasses, choosing the optimal policy for your needs becomes crucial. Here are some key factors to consider:

- Claim Limits: Extras policies have limits on the amount you can claim per service. These limits come in various forms, including annual and lifetime limits. Understanding these limits helps you choose a plan that aligns with your anticipated vision needs.

- Family History: If you have a family history of vision-related conditions, a higher level of coverage might be beneficial, offering more comprehensive coverage for potential future needs.

- Waiting Periods: Waiting periods are the time you must wait after taking out a policy before being eligible to claim certain services. Extras cover waiting periods for optical services, which can vary between health funds, so pay close attention to these details.

Maximising Your Health Fund Glasses Benefits

Here are some expert tips to get the most out of your Health Fund Glasses coverage:

- Utilise Your Full Benefits: Explore the range of services covered by your optical cover. While glasses and contact lenses are common claims, some plans also cover eye therapy and prescription sunglasses.

- Seek High Annual Limits: Look for policies with high annual limits to minimise out-of-pocket expenses. Additionally, compare the percentage of coverage offered by different funds. Some may offer 100% reimbursement up to the limit, while others might have varying ratios depending on the service.

- Explore Special Offers: Many health funds have partnerships with optical stores and chains. These partnerships can translate into additional discounts on Progressive lenses with your purchase.

What Does Health Fund Glasses Cover?

Combining a hospital and extras policy allows you to be covered for both inpatient and outpatient eye care. Here’s a breakdown of the services covered:

- Hospital Cover: This can cover private inpatient hospital treatment for eye conditions like cataracts, glaucoma, and retinal detachment.

- Extras Cover: This helps pay for prescription glasses, contact lenses, and even vision therapy to treat issues like blurred vision or lazy eye. Depending on your policy and annual limits, you can claim a new pair of glasses annually. Additionally, your health fund may offer exclusive benefits like member discounts or partnerships with eyewear retailers.

Understanding Coverage Levels

Does the level of extras cover impact the benefits you receive for Health Fund Glasses? Absolutely. Some extra policies exclude optical coverage entirely, while others include it with limitations that vary based on the chosen tier. Higher-tier extras typically offer higher rebates and claim limits for optical services, while lower tiers might leave you with a higher out-of-pocket cost.

The amount you can claim back also depends on your specific policy. Some insurers offer a fixed dollar amount for glasses and frames, while others might reimburse you for a percentage of the cost. Understanding these details allows you to make informed decisions when choosing a policy.

Waiting Periods for Health Fund Glasses

Waiting periods for claiming depend on the health fund, the service, and your policy type. Inpatient treatment typically has a two-month waiting period, which can extend to 12 months for pre-existing conditions.

Extras cover may have a two to six-month waiting period for claiming on glasses, contact lenses, or eye therapy. Laser eye surgery usually involves a longer wait time, which the fund and policy determine.

Promotions sometimes waive these waiting periods, allowing immediate claims for glasses and eye therapy. However, always check the policy details to understand what’s covered.

Eye Therapy Coverage:

Some extra policies can help pay for eye therapy by a qualified practitioner. This might come at an additional cost and be subject to waiting periods and limits.

Typical coverage limits for eye therapy include:

- A set amount per visit (e.g., $50)

- An annual limit per policy (e.g., $350)

- A group limit for combined therapies (eye, speech, occupational)

- A service limit (e.g., one initial consultation per year)

How does Medicare bulk billing work for optical services and eye tests?

If you are eligible for a free annual or three-yearly eye test and your optometrist bulk bills your examination, you won’t have to make any payment. However, if the optometrist does not bulk bill your eye test, you will need to pay the fee upfront and then claim back 85% of the scheduled fee from Medicare.

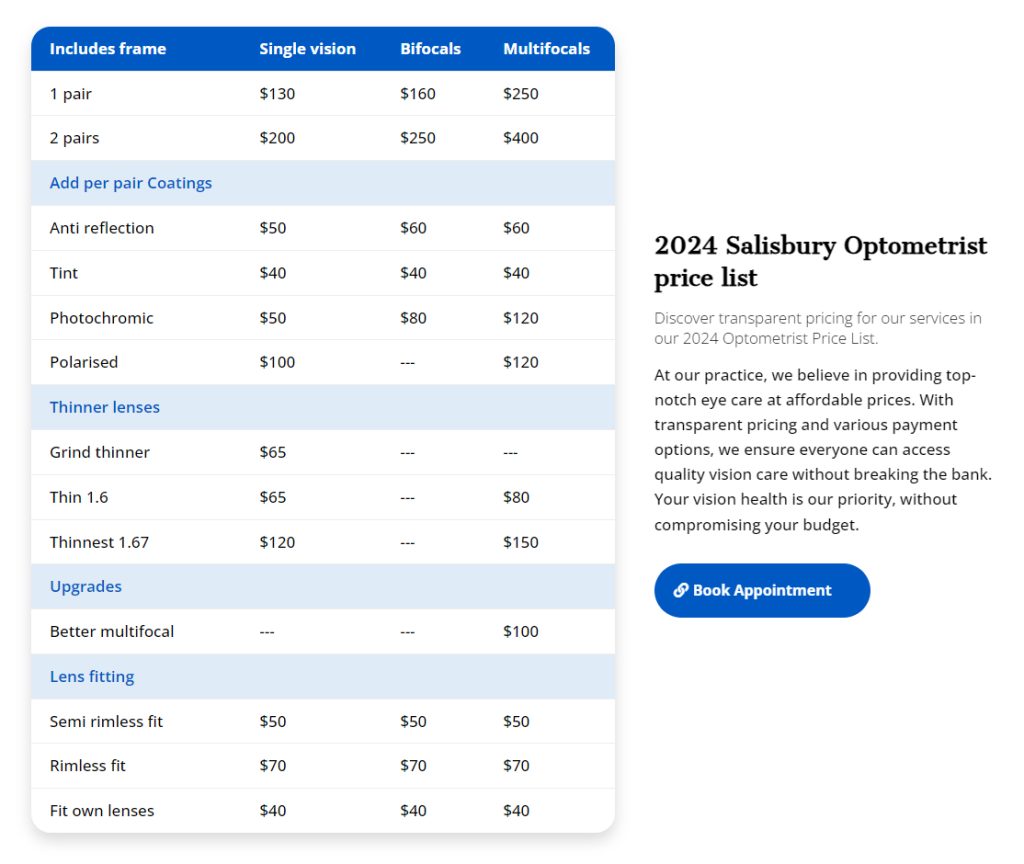

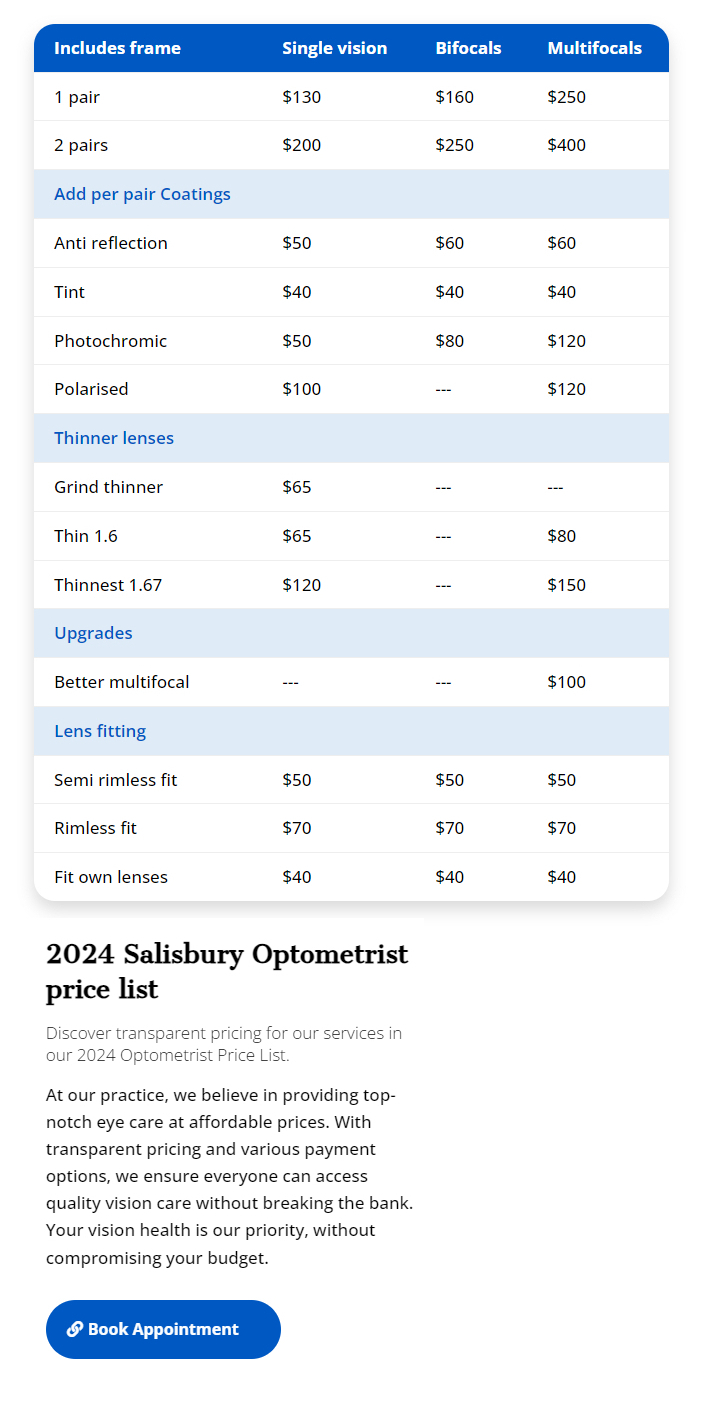

We Have the Perfect Health Fund Glasses for You

Visit Salisbury Optometrist! We help you navigate your insurance benefits for glasses and contacts. Our in-store claims process is quick and easy, and we provide detailed receipts for online purchases. For expert advice and a wide selection of glasses, consider visiting Salisbury Optometrist.

0 Comments