In today’s digital age, our eyes are constantly exposed to screens, artificial lighting, and other potential stressors. As a result, maintaining good optical health has become increasingly important. Luckily, many health insurance plans offer optical benefits that can significantly reduce the financial burden of eye care.

In this comprehensive guide, we will provide in-depth information on optical health fund benefits, ensuring that you make the most of your coverage while prioritising your eye health.

Optical Health Fund Benefits

Optical health fund benefits are typically included as a part of health insurance plans, providing coverage for various eye care services and products. These benefits can include eye exams, prescription glasses, thin glasses, contact lenses, and even corrective surgeries such as LASIK. It’s important to thoroughly review your insurance policy to understand the specific benefits and coverage limits it offers.

Know Your Coverage Details:

Begin by reviewing your insurance policy documents. Understand what is covered and what isn’t. Note the frequency limits for different services, maximum coverage amounts, and any waiting periods.

Regular Eye Exams:

Routine eye exams are crucial for early detection and prevention of eye problems. Many insurance plans cover annual eye exams. Schedule these appointments to maintain optimal eye health and make the most of your benefits.

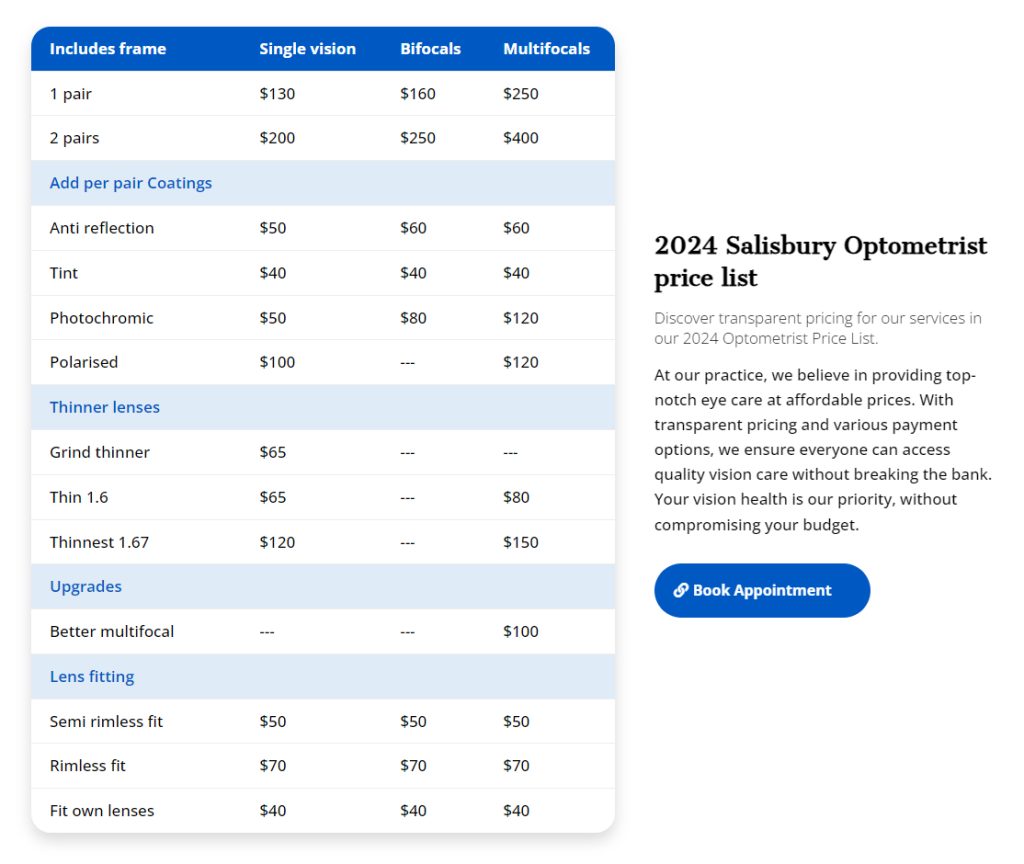

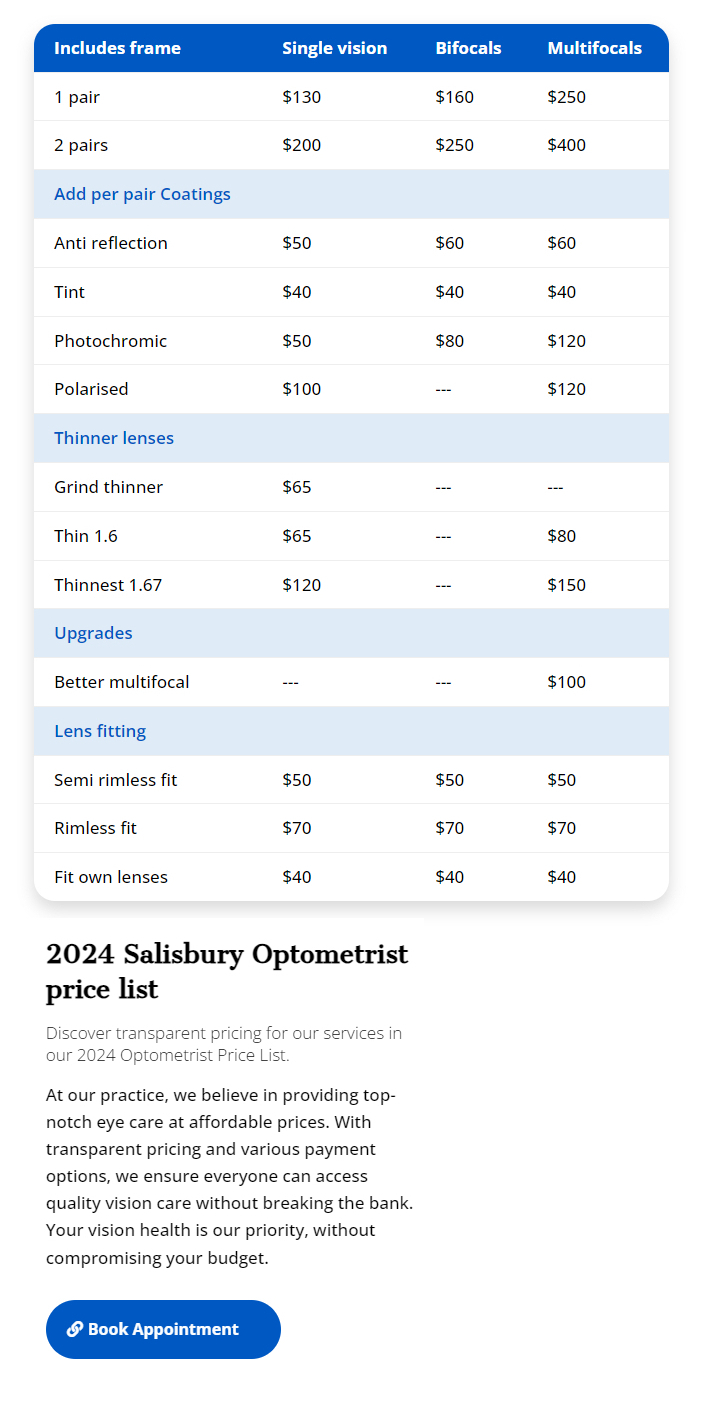

Prescription Glasses:

If you require prescription glasses, your insurance plan may cover a portion or the entire cost. You can buy suitable health fund glasses under that insurance plan. Some plans have a fixed allowance for frames and lenses. Be sure to inquire about any restrictions on designer frames or specific lens options.

Contact Lenses:

For those who prefer contact lenses, explore whether your plan covers them. Some plans provide a yearly allowance for contact lenses, which can help offset the costs.

Specialised Eye Care:

If you have specific eye conditions, such as astigmatism or presbyopia, your plan might cover specialised lenses or treatments. Consult your eye care professional to determine the best options for your needs.

Ways to Utilise Your Optical Benefits

Network Providers:

Many insurance plans have a network of preferred eye care providers. Visiting these in-network professionals often results in lower out-of-pocket costs. Verify the list of network providers and choose one that suits your preferences. Salisbury Optometrist is one of the leading eye care centres where you can easily find different types of health fund glasses.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs):

FSAs and HSAs are tax-advantaged accounts that allow you to set aside pre-tax money for medical expenses, including eye care. Funds from these accounts can be used to pay for deductibles, co-pays, and even non-covered expenses like designer frames.

Bundle Services:

Some insurance plans offer bundled benefits, combining optical coverage with other health-related services. Explore whether you can leverage these bundles for greater cost savings.

Timing Matters:

If you anticipate needing new glasses or contacts, consider timing your purchases to align with your coverage renewal period. This way, you can fully utilise your benefits without missing out.

Comparative Shopping:

When purchasing frames or lenses, don’t hesitate to look around. Compare prices at different optical stores and online retailers to find the best deals that match your insurance coverage.

Utilise Discounts:

Insurance plans often provide discounts on eyewear, especially on thin glasses and contact lenses, through affiliated retailers. Take advantage of these discounts to further reduce your costs.

Prior Authorisation:

Some treatments, especially surgical procedures, may require prior authorisation from your insurance provider. Make sure to follow the necessary steps to avoid unexpected denials.

Wrapping It Up

Optical health is an essential aspect of overall well-being, and leveraging your optical health fund benefits can make a significant difference in maintaining clear vision. By understanding your insurance coverage, staying informed about your benefits, and making strategic choices, you can optimise your optical health fund benefits to the fullest.

0 Comments